The problems with shared ownership

Posted: April 11, 2024 Filed under: Section 106, Shared ownership Leave a commentOriginally written as a column for Inside Housing.

Is shared ownership at a crossroads or a dead end?

The fact that the question has to be posed at all is an indications of the issues now facing the part-buy, part-rent product that has been a mainstay of the affordable home ownership market, Section 106 planning contributions and housing association development programmes over the last three decades.

But after a month that has seen a critical report published by an all-party committee of MPs and relentlessly negative media coverage based on the personal experiences of shared owners, it is also a question that needs answers urgently.

A front-page story in The Observer featured shared owners who have fallen victim to soaring service charges and increases of more than 40 per cent in a year.

With grim irony, they had bought homes at Elephant Park in south London, site of the controversial demolition of the Heygate estate that was meant to be a showpiece for market-led regeneration.

BBC London has reported on cases including a shared owner in King’s Cross in north London whose annual service charge for 2024 rose 274 per cent from £4,200 to £16,000.

There may be many shared owners out there who are happy with their home but these are far from the first horror stories and sadly they will not be the last about a tenure that is meant to offer buyers an affordable way to staircase their way up the housing ladder.

The all-party Levelling Up, Housing and Communities (LUHC) Committee published a report just before Easter highlighting above-inflation rent increases, uncapped service charges, repairs and maintenance liabilities and complex leases that it said make shared ownership ‘an unbearable reality’ for people looking to become full owners.

Read the rest of this entry »The Housing Question No 13: Solving the housing challenge

Posted: February 16, 2024 Filed under: Uncategorized Leave a commentMy Substack newsletter this week analyses a week of big housing announcements that fail even on their own terms, asks why the Conservatives have fallen into an electoral trap of their own making and examines some ominous news on affordable housing in London. To read the latest issue go here.

Gove enters the multiverse

Posted: February 16, 2024 Filed under: Home ownership, Housebuilding, Planning | Tags: Michael Gove Leave a commentOriginally written as a column for Inside Housing.

Everything everywhere all at once’ is how Michael Gove describes the welter of proposals on housing announced this week and under consideration for the Budget next month.

In one of the alternative realities that make up in the multiverse in the 2022 film, this is his Long-Term Plan for Housing producing results at last. In another, the Conservatives end their in-fighting and build on their victories in Thursday’s two by-elections.

In an interview with the Sunday Times, the housing secretary makes clear what he believes is at stake if young people feel they are excluded from home ownership: ‘If people think that markets are rigged and a democracy isn’t listening to them, then you get — and this is the worrying thing to me — an increasing number of young people saying, ‘I don’t believe in democracy, I don’t believe in markets.’

And he says he remains committed to a ban no-fault evictions via the Renters Reform Bill and determined to face down opposition from ‘vested interests’ to the Leasehold and Freehold Reform Bill.

Read the rest of this entry »The Housing Question No 11: Disasters happen and they walk away

Posted: January 19, 2024 Filed under: Uncategorized Leave a commentThe Housing Question, my newsletter over on Substack, is the other place to find my writing on everything to do with housing.

The latest edition considers the parallels between the Post Office and building safety scandals and asks what it takes to break into the public consciousness and hold people to account. It also looks at government action and inaction on poor housing and why longer-term mortgages are not a quick fix. You can subscribe here (it’s free for now).

The Housing Question No 10: A big offering on housing

Posted: January 5, 2024 Filed under: Uncategorized Leave a commentIf you haven’t yet caught up with The Housing Question, my Substack newsletter featuring all things housing, it’s available here.

The latest issue features a Damascene conversion for Brandon Lewis on housebuilding and planning, auguries of austerity from Wales and Scotland, some intriguing hints from Labour and the Conservatives ahead of an election year and Louise Casey’s Radio 4 Series Fixing Britain. It’s free to read for now.

The state of the housing nation 2023

Posted: December 18, 2023 Filed under: Bedroom tax, Energy efficiency, Private renting, Tenants, Tenure change | Tags: English Housing Survey Leave a commentAs 2023 draws to a close, what is the state of the housing nation?

As always, the best place to start is the English Housing Survey, which has just published headline results for 2022/23. Here are five things that caught my attention.

1 The tenure and wealth gap

The results of the survey need to be treated with more caution than usual when comparing the results this year thanks to the impact of the pandemic, but the general trend on housing tenure is pretty clear.

Thanks in part to Help to Buy and other government schemes, the proportion of households who own their own home (64 per cent) has stabilised while the relentless growth of the private rented sector (18 per cent) has slowed. The social housing sector is still in slow decline but there is a significant difference between London (where it is home to 21 per cent of households) and England as a whole (16 per cent).

There were 874,000 recent first-time buyers in 2022/23 and they had an average (mean) deposit of just over £50,000.

Given that, it’s not surprising that family wealth has become increasingly important to people’s chances of buying. A growing proportion received help from family or friends (36 per cent, up from 27% in 2021/22 and 22 per cent in 2003/04) while 9 per cent used an inheritance for a deposit.

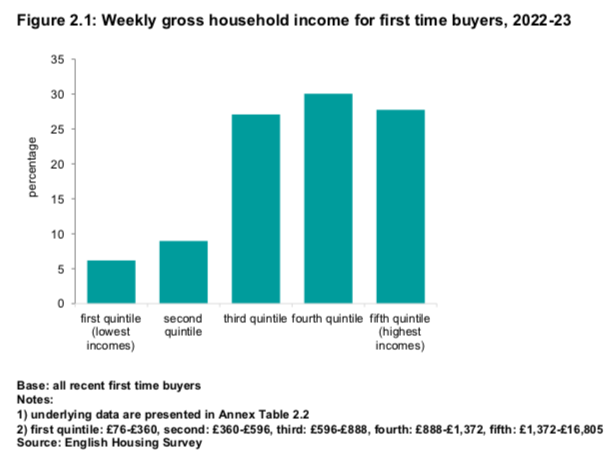

They were also higher earners: the majority of successful first-time buyers (58 per cent) came from the top two income quintiles and only a small minority (16 per cent) came from the bottom two.

Temporary accommodation, permanent shame

Posted: December 1, 2023 Filed under: Bed and breakfast, Homelessness, Temporary accommodation Leave a commentOriginally written as a column for Inside Housing.

Everywhere you look in the latest homelessness statistics, the scale of the crisis facing homeless families and local councils alike stares back at you.

The total number of homeless households in temporary accommodation (which can mean anything but) went past the record highs of the mid-2000s earlier this year and rose to another record of 105,750 in the 12 months to the end of June.

That’s up 1.2 per cent on the previous three months ago and 10.5 per cent on last year. The total included 68,070 families with 138,930 children (another record).

These figures are stark enough at a national level but in the worst-affected local authority, Newham, 50.2 out of every 1,000 households in Newham were in temporary accommodation.

But drill down further and the really shocking increases are in the numbers stuck at the most miserable end of the TA crisis in bed and breakfast hotels.

Read the rest of this entry »Autumn Statement brings good news (for now) on LHA

Posted: November 23, 2023 Filed under: Affordable housing, Local housing allowance, Permitted development, Temporary accommodation | Tags: Autumn Statement Leave a commentOriginally written as a column for Inside Housing.

The good news in Jeremy Hunt’s speech is that the government has finally listened to all the arguments about soaring rents, evictions and homelessness and Local Housing Allowance (LHA) rates will be linked to private rents again from next April.

The bad news buried in the background documents to his Autumn Statement is that rates will be frozen again for the four years after that, recreating the shortfalls between housing benefit and rents for tenants and generating all the costs of homelessness that led to the lifting of the freeze in the first place.

It’s not much of a way to run a benefits system or a housing system but it is entirely in keeping with an Autumn Statement characterised by even more smoke and mirrors than a usual Budget.

That’s amply demonstrated by the most headline-grabbing measure: the cut in National Insurance will not actually mean a tax cut for households hit by a continued freeze in the thresholds for income tax, although it does at least benefit workers (who pay NI and income tax) rather than landlords and shareholders (who only pay income tax).

And the cuts in NI and business tax are made possible in the first place by more sleight of hand: as the accompanying report from the Office for Budget Responsibility reveals, they only add up thanks to unfeasibly large cuts in public services and a freeze (aka significant real terms cut) in capital spending after the next election.

Needless to say that leaves next to no room for investment in new social homes or the decarbonisation of the existing stock even though the real value of both continues to be squeezed by inflation.

Instead, beneath the surface of the statement, there are signs of a desperate search for policies that are not affected by the squeeze on public spending.

Read the rest of this entry »